PPT Choosing The Right Legal Structure For The Business PowerPoint Presentation ID1651619

Unlimited liability is a legal and financial concept where business owners or partners are personally responsible for all the debts and responsibilities of the business. In simple terms, if the company can't pay its debts, the owner's personal belongings, apart from what they put into the business, can be used to pay off the debts.

PPT Forms of business Ownership PowerPoint Presentation, free download ID1632607

This guide looks at unlimited liability in business, explaining the pros, cons, and the differences between limited and unlimited liability companies.

PPT BUSINESS ORGANISATIONS AND LEGAL FORMS OF BUSINESS ORGANISATIONS PowerPoint Presentation

Unlimited liability means business owners are responsible for their companies' debts. This is an important term in the business world because companies are likely to take on debt to continue operating. Many businesses will borrow money for: Expansions. New operations.

Business Concept Meaning Unlimited Liability with Sign on the Sheet Stock Image Image of

Unlimited liability is the legal obligation of company founders and business owners to repay, in full, the debt and other financial obligations of their companies. The legal obligation generally exists in businesses that are sole proprietorships or general partnerships.

What is Unlimited Liability in Business UK Business Magazine

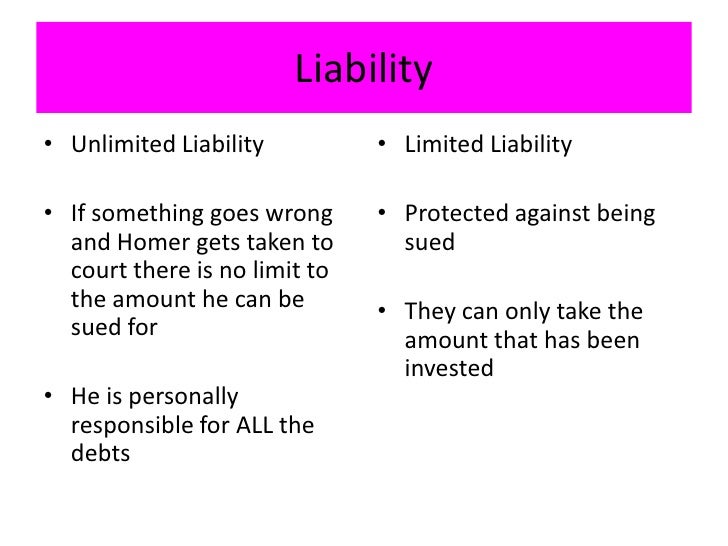

What is unlimited liability? The definition of 'unlimited liability' is "the full legal responsibility that business owners and partners assume for all business debts". This responsibility is not limited and, unlike the well-known limited liability corporate structure, liabilities may be satisfied by the seizure and sale of the owners.

Limited Liability Partnership (LLP) Partnership Structure Kalfa Law Firm

Unlimited liability means that your partners and shareholders are also liable if the company goes bankrupt. That level of risk is enough to put off a lot of investors, so it could prove much harder to secure funding from private investors. This will generally make growth a lot more difficult.

What is Unlimited Liability?

Unlimited liability refers to the legal obligations general partners and sole proprietors because they are liable for all business debts if the business can't pay its liabilities. In other words, general partners and sole proprietors are responsible for paying off all of the company debts personally if the company can't make its payments..

What is Unlimited Liability in Business Complete guide I Do Business

Unlimited Liability: An unlimited liability business involves joint owners that are equally responsible for debt and liabilities accrued by the business; this liability is not capped and can be.

PPT Business Ownership in the Private Sector PowerPoint Presentation ID1644883

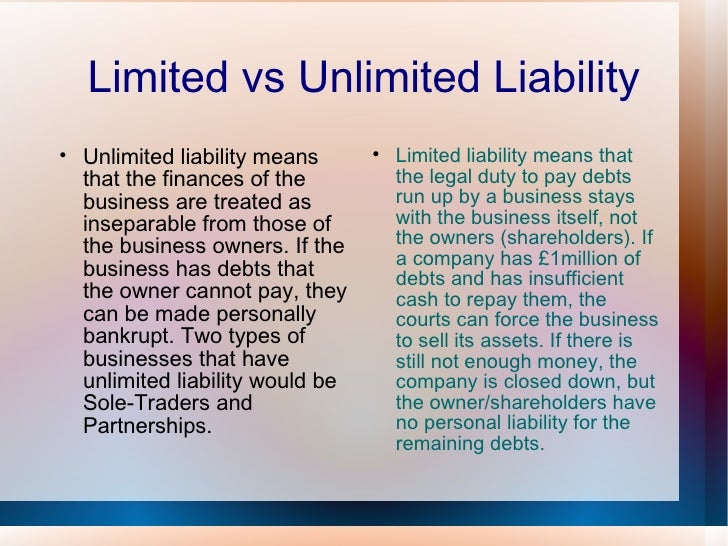

Unlimited liability means that the owners of the company are personally liable for the debts and obligations of the business. This is in contrast to limited liability, which protects the owners' personal assets in the event that the business can't pay its debts. If a limited liability company runs into financial trouble and has to close.

What is Unlimited Liability in Business? eBusiness blog

Unlimited liability partnerships. Unlimited liability partnerships are formed when two or more people start a business together. Each partner can make decisions on the other's behalf that may create obligations for them. For example, if one owner takes out a business loan, all other partners will share liability for the debt.

BUSS1 Overview

Unlimited Liability Explained. Unlimited liability in partnership is the concept in which the members of a firm are all equally responsible for the risks of loss or any 1 debt the company has taken to meet its operating expenses.. In business, has its advantages and disadvantages. The formation of a business regarding its liability has to be considered based on the nature of the business.

Benefits Of Unlimited Liability I Do Business

Unlimited liability means that the owners of the company will be responsible for all obligations and debts incurred by the business. This means they will be held accountable to clear any debts that mount up if they can't be cleared through the business itself.

Unlimited Liability Definition

/etsy-ipo-opens-on-nasdaq-469939860-5df9b81a902246f0bbec701941eddfd4.jpg)

Unlimited liability is when one or more individuals are liable for their company's taxation and debts. In this regard, it is very different to a limited liability company (LLC). The latter is designed specifically to insulate individual LLC members (partners or stakeholders) from risk. As such, no single person's assets are affected if the.

Limited Liability VS Unlimited Liability A Level Business/ A level Economics B/GCSE Business

An unlimited liability company (ULC) is, for financial and tax purposes, inextricable from its owner. The owner is personally accountable for the company's liabilities, but is also entitled to the company's profits after taxes. In the US, a ULC is referred to as a hybrid company. It is an incorporated entity with unlimited liability.

Limited and unlimited liability Business studies concepts YouTube

Unlimited liability is a term used in business, law and accounting to refer to a person's exposure to all types of financial liability. In other words, unlimited liability means that a person can be potentially held responsible for all debt or financial obligations related to owning and operating a business, contractual obligations or legal.

Ownership and control

Unlimited liability is a legal concept that refers to the full legal and financial responsibility that business owners or partners have for all the debts and obligations of their business. In other words, if the business is unable to pay its debts or is sued, the owner's personal assets, such as their savings or property, can be used to satisfy.

.